Let's talk about storage unit contents insurance. The simplest way to think about it is as a dedicated safety net, but one specifically designed for the belongings you keep outside your home. It’s a specialised policy that protects your items against things like theft, fire, and water damage while they’re tucked away in a self-storage facility. Ultimately, it’s all about providing financial peace of mind.

Why You Need Storage Unit Contents Insurance

Picture your storage unit as a secure, temporary home for your possessions. Whether you're stashing furniture during a house move, archiving crucial business documents, or just creating some breathing room at home, those items have real value. While any reputable storage facility will have great security features like CCTV and alarms, no one can prevent every possible mishap.

This is exactly where a dedicated insurance policy shifts from a 'nice-to-have' to a genuine necessity. It plugs a critical gap that your standard home insurance almost certainly creates. Most home contents policies simply don’t extend full cover to items stored off-site for long periods, leaving your valuables exposed if the unexpected happens.

Facing the Real-World Risks

Without proper storage unit contents insurance, you’re leaving yourself financially vulnerable to some all-too-common risks. Think about it: a burst pipe in the unit next door could lead to devastating water damage, a fire could wipe everything out, or a determined thief might find a way in. These aren't just abstract worries; they are real scenarios that can cause significant financial loss and a whole lot of stress.

By insuring your goods, you’re not just buying a policy; you’re securing a promise that if something goes wrong, you won’t have to bear the cost of replacing everything out of your own pocket. It's a fundamental part of a smart storage strategy.

To make it crystal clear, here’s a quick rundown of why this insurance is so essential.

At a Glance: Why Storage Insurance Is Essential

| Risk Factor | How Storage Insurance Protects You |

|---|---|

| Theft | Provides financial reimbursement if your unit is broken into and items are stolen. |

| Fire & Water Damage | Covers the cost of replacing or repairing goods damaged by fire, smoke, or water from leaks or floods. |

| Natural Disasters | Offers a financial safety net against damage from events like storms or flooding. |

| Home Insurance Gaps | Fills the specific exclusion most home policies have for items stored off-site long-term. |

| Facility Requirements | Meets the mandatory insurance condition required by most UK storage providers. |

This table neatly sums up the core protections. It's about covering all your bases so you can use your storage unit with confidence.

Is Storage Insurance Mandatory in the UK?

Yes, for the most part. In the UK, the vast majority of self-storage providers make contents insurance a mandatory condition of the rental agreement. This policy protects both you, the customer, and the facility itself, establishing a clear baseline of financial security.

With the average cost of renting storage space running at about £27.19 per square foot annually, and knowing that standard home insurance won’t cover it, this specialised cover is the only way to get proper protection.

This requirement really highlights how seriously the industry takes protecting customer belongings. Of course, there are many other practical benefits of using self-storage, from decluttering your life to giving a growing business the space it needs. Whatever your reason for renting a unit, making sure your items are insured is a non-negotiable step for total peace of mind.

Understanding Your Insurance Coverage

When you take out storage unit contents insurance, it’s tempting to just tick the box and assume you’re protected. But it’s vital to realise that not all policies are created equal. Think of it as a detailed agreement—the small print really does matter because it sets the precise boundaries of your protection. Getting to grips with what’s covered, and just as crucially, what isn't, is the only way to be sure you have the right safety net for your belongings.

A good policy is built to cover the kinds of things most people put into storage. It’s there to shield you financially from common disasters like theft, fire, floods, and other accidental damage.

What Is Typically Covered by Storage Insurance?

Most standard policies will cover a broad spectrum of household and business items. This is designed to ensure the majority of what you’re storing is protected if the worst should happen. The aim is to provide the funds to replace those goods.

In general, you can expect your insurance to cover things like:

- Furniture: Sofas, tables, beds, and wardrobes.

- Electronics: Computers, televisions, and stereo systems.

- Appliances: White goods such as washing machines and fridges.

- General Household Goods: Clothes, books, kitchenware, and soft furnishings.

- Business Stock: Non-perishable inventory and equipment.

- Archived Documents: Business records and important files.

This broad-strokes coverage gives you a decent foundation of security. However, it’s always smart to dig into the specifics of your chosen policy, paying close attention to its limits and conditions. Many people wonder whether renters insurance covers storage units, and it's essential to clarify this, as a dedicated policy is often the only way to get proper cover.

What Is Usually Excluded from Cover?

Knowing what isn’t covered is just as important as knowing what is. Insurers have specific exclusions to manage their risk, and being aware of them will save you from a nasty shock if you ever need to make a claim.

Policy exclusions aren't there to catch you out. They exist because certain items are simply too risky, too valuable for a standard policy, or illegal to store in the first place. It falls on you to check this list before you lock up your unit.

Common items you'll find on most exclusion lists for storage unit contents insurance include:

- High-Value Collectables: Jewellery, fine art, antiques, and stamp collections typically need specialist insurance.

- Perishable Goods: Food, plants, or anything else that can spoil or rot.

- Live Animals: Storing any living creature is strictly forbidden and unsafe.

- Flammable or Hazardous Materials: This includes petrol, paint, chemicals, and explosives.

- Illegal or Illegally Obtained Items: Anything that is against the law to own or possess.

- Vehicles: Cars, motorbikes, and boats almost always require their own separate insurance policies.

By understanding these boundaries, you can run through a quick mental checklist of your belongings. This simple, proactive step ensures you aren’t paying for a policy that can’t protect what you need it to, and it’s a clear sign when you might need to look for more specialised cover.

How Much Does Storage Unit Insurance Cost in the UK?

Figuring out the price of protecting your stored belongings is much more straightforward than you might imagine. There isn't a single, fixed cost for storage unit contents insurance. Instead, the price is shaped by a few important factors, mainly the value of your goods and the level of protection you need.

It's a bit like insuring a car; the premium is tied to the car's value and how securely it's kept. In the same way, the single biggest factor for your storage insurance cost is the total value of the items you're putting away. The more your things are worth, the higher the premium will be to make sure you’re fully covered if something goes wrong.

The security at the storage facility itself also plays a big part. Facilities like Admiral's Yard, which have invested in 24/7 CCTV, secure gated access, and alarm systems, are actively reducing the risk of theft or damage. This commitment to security can often help keep insurance costs down.

Getting an Accurate Quote Starts With Valuing Your Goods

Before you can get a precise cost, you need to work out the total replacement value of everything you intend to store. This step is absolutely critical. Trying to save a few quid by undervaluing your items could leave you seriously out of pocket if you ever have to make a claim.

The best way to do this is to create a detailed list and assign a realistic, new-for-old replacement cost to each item. Think about what it would cost to buy them brand new today. For instance:

- Sofa: £800

- Television: £500

- Business Files (Cost to recreate): £1,000

- Bed Frame & Mattress: £700

Once you add everything up, you'll have your total 'sum insured'. This is the figure the insurer uses to calculate your premium. To simplify things, our handy self-storage calculator can help you estimate both the storage space and the value you need to cover.

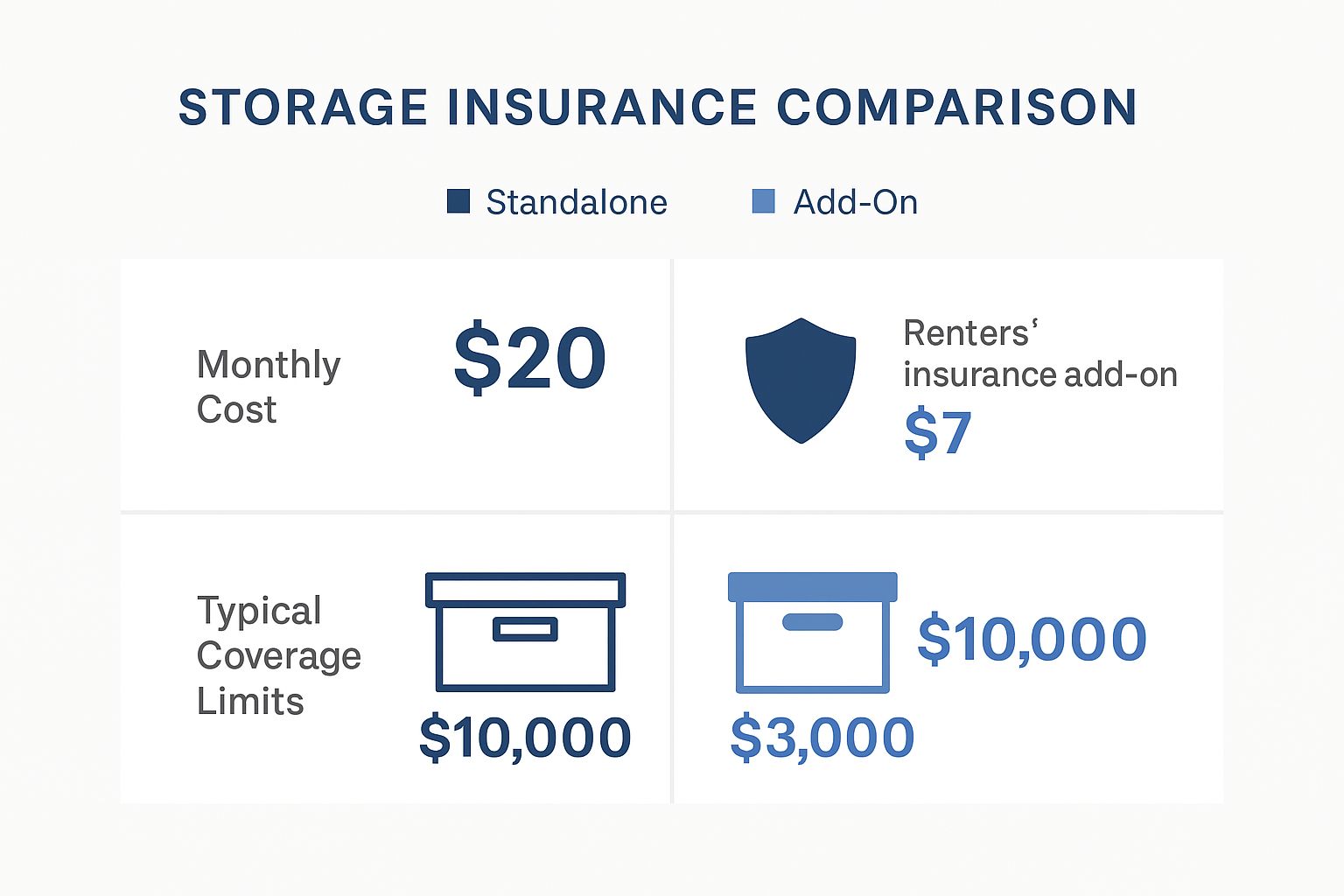

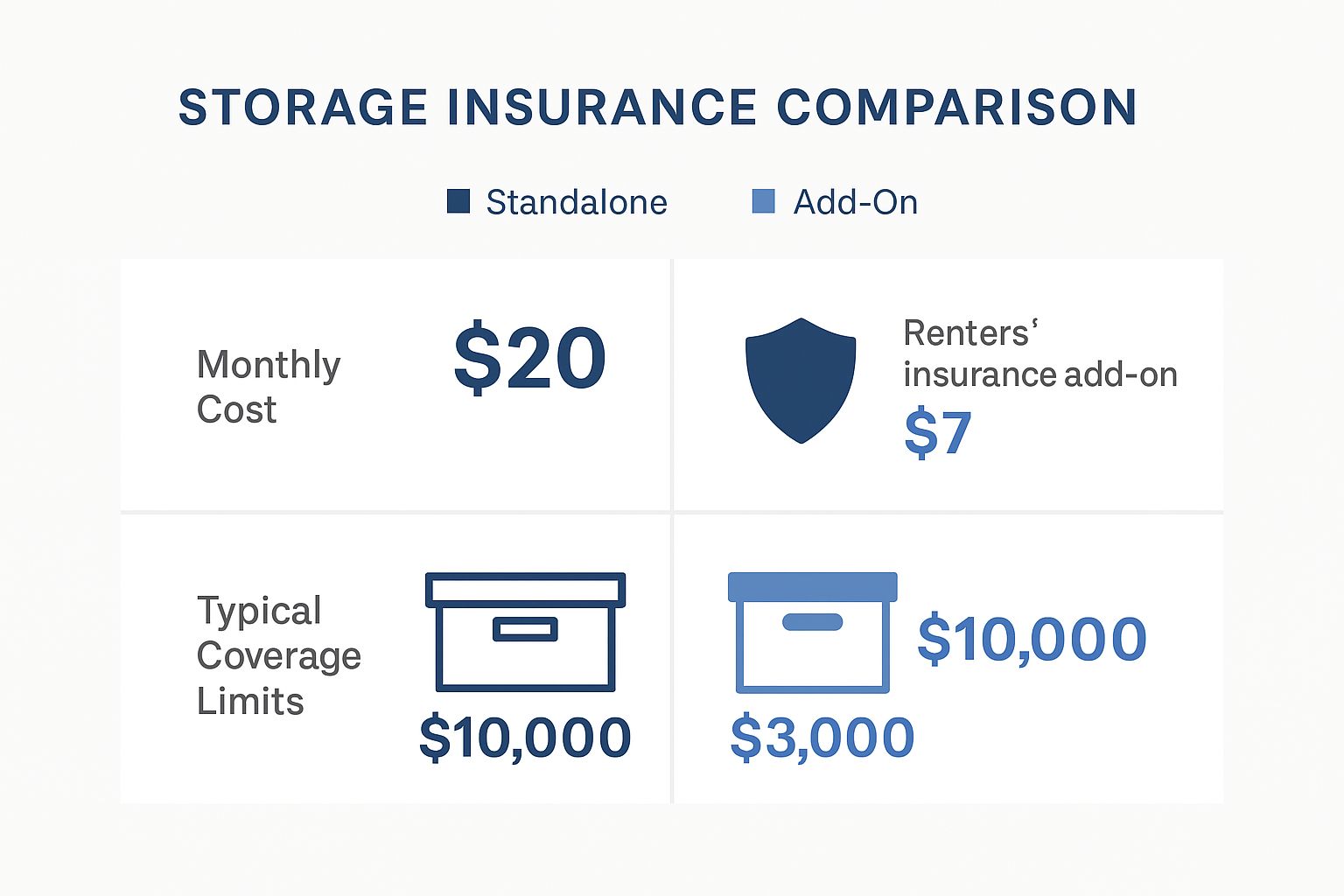

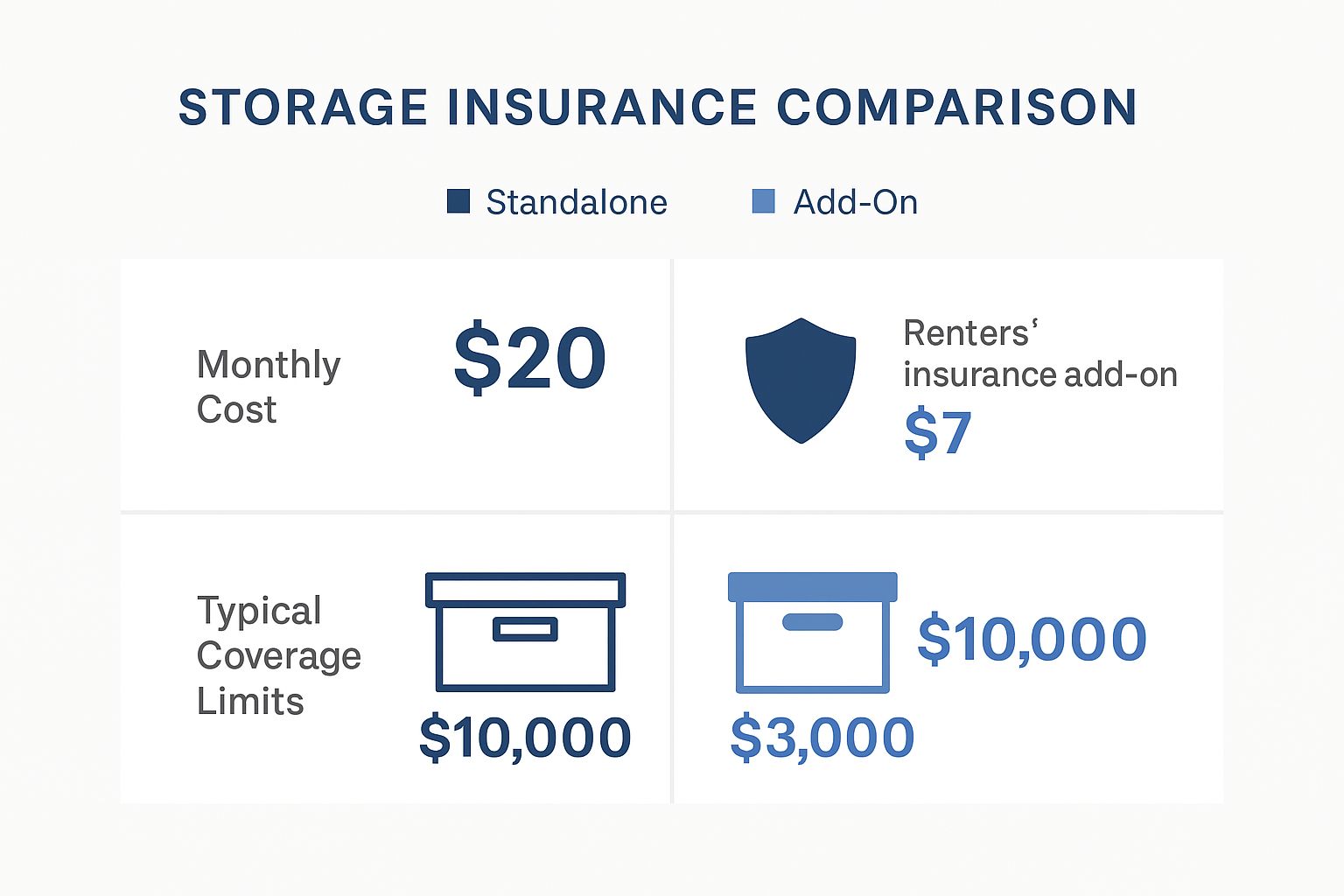

Facility vs. Third-Party Insurance Costs

When it's time to buy a policy, you typically have two main options: get it directly from the storage facility or find a policy through a third-party specialist. While buying insurance from the facility is incredibly convenient, it really pays to look at all your options.

The cost of storage insurance in the UK can vary wildly. Shockingly, some customers have been charged up to seven times the standard rate by storage providers. Being a savvy shopper can save you a lot of money.

Specialist third-party insurers, on the other hand, can sometimes offer policies that are much cheaper than those sold directly by storage companies. Since most facilities will require you to have some form of insurance, it’s always a good idea to compare different policies to find one that’s both affordable and comprehensive.

As a general guideline, basic cover for goods valued up to £2,000 can start from as little as £3 to £5 per week. The cost goes up from there depending on the value of your items, but it's a small price to pay for complete peace of mind.

Choosing the Right Insurance Policy for You

Picking the best insurance for your storage unit can feel a bit like a tightrope walk. You're balancing the need for solid protection against the desire to not overpay. But with a bit of know-how, you can confidently find a policy that gives you the right mix of cover, cost, and convenience.

The first, and most important, step? Figure out what your stuff is actually worth. This is no time for a quick guess. One of the biggest mistakes people make is undervaluing their belongings, which can leave them seriously out of pocket if they ever need to make a claim.

Calculating the Value of Your Goods

Before you even think about looking at policies, you need to create a detailed list of every single thing you plan to put into storage. Go through your items one by one and give each a ‘new-for-old’ replacement value. This isn't what you paid for it years ago, or what you could sell it for on a marketplace; it's what it would cost to buy that item brand new today.

Think of it like this:

- Dining Table and Chairs: £650

- Laptop and Printer: £900

- Collection of Books (approx. 100): £1,000

- Archived Business Paperwork (cost to reproduce): £500

Add it all up, and that final number is your ‘sum insured’. This is the level of cover you need to ask for. It’s your safety net, ensuring you have the funds to replace everything if the worst should happen. This process is just as crucial for business owners, who must account for the value of stock, equipment, and vital documents. Understanding the benefits of using self-storage for your business can help you get a much clearer picture of your storage and insurance needs.

Comparing Your Insurance Options

Once you have your total value, you can start weighing up your two main choices: insurance offered directly by the storage facility, or a separate policy from a third-party specialist insurer.

Facility-provided insurance, like our StoreProtect scheme, offers pure convenience. You can get it all sorted in one go when you sign up for your unit. On the other hand, it's sometimes worth shopping around with specialist insurers, as they might offer slightly different terms or more competitive rates. It never hurts to get a few quotes to see who gives you the best value for the cover you need.

To help you decide which path is right for you, here’s a quick comparison of the two main approaches.

Facility Insurance vs Third-Party Insurance

| Feature | Facility-Provided Insurance (e.g., StoreProtect) | Third-Party Specialist Insurance |

|---|---|---|

| Convenience | Excellent. Set up on-site when you rent the unit. | Requires separate research and application. |

| Coverage | Specifically designed for self-storage risks. | May offer broader cover but check for storage-specific exclusions. |

| Claims | Streamlined process with the facility staff you already know. | Handled by an external company you may not have dealt with before. |

| Flexibility | Easy to adjust cover up or down as you add/remove items. | Can be more complex to change your policy mid-term. |

| Cost | Often very competitive and cost-effective. | Can sometimes be cheaper, but you need to compare quotes. |

Ultimately, facility-provided insurance often wins on sheer ease and having cover that's perfectly matched to the environment, while a third-party policy might occasionally save you a few pounds if you're prepared to do the legwork.

Key Questions to Ask Any Insurer:

Before you sign on the dotted line with any provider, make sure you get clear answers to these questions:

- What is the exact process for making a claim?

- What is the policy excess (the amount you have to pay towards any claim)?

- Are there any specific exclusions I need to be aware of?

- How do I change my cover level if I add or remove things from my unit?

Asking these simple questions upfront helps you look beyond the price tag and ensures there are no nasty surprises waiting for you later. It empowers you to choose a policy that genuinely works for you.

The Booming UK Self-Storage Market

To really get why storage unit contents insurance matters, it helps to look at the bigger picture. The self-storage industry in the UK isn't just a niche service anymore; it's a massive, fast-growing market that’s changing because of how we live and work. Think about it: cities are getting more crowded, homes are getting smaller, and more of us are working flexibly. All these trends mean people desperately need extra space.

This isn't just a fleeting trend. For countless people, from families caught between house moves to students needing a spot for their stuff over the holidays, self-storage has become a go-to solution. As more and more people pack their belongings into these units, the total value of everything stored is staggering. That’s precisely why having solid protection for your own items is no longer just a good idea—it’s crucial.

A Market Experiencing Major Growth

The UK's self-storage industry is a serious business, valued at around £1.08 billion a year as of early 2025. We're talking about more than 2,200 facilities across the country, offering over 52 million square feet of space. And it’s not slowing down. Projections show it’s set to grow at a healthy 7.9% each year between 2024 and 2028. You can find more insights on the future of UK self-storage at sostorage.co.uk.

As more individuals and businesses come to depend on storage, the need for proper insurance to cover what’s inside naturally grows right alongside it.

This boom isn't just about personal storage for moving house or decluttering. It represents a fundamental shift in how we manage our physical assets in a world where space is at a premium. Your decision to get insurance is part of a wider trend of protecting valuables in this growing market.

The market's expansion includes all sorts of specialised options, like e-commerce storage units built for the demands of online businesses, which just shows how essential the industry has become to our economy. In such a busy and expanding landscape, taking personal responsibility for protecting your belongings with dedicated insurance isn't just smart; it's a necessary step.

Right, let's walk through what to do if you ever need to make a claim on your storage insurance. Finding your belongings damaged or gone is a deeply upsetting experience, but knowing the right steps can bring a sense of control to a stressful situation and help you get things sorted.

The process itself is usually quite straightforward. The key is to act quickly and methodically from the moment you discover a problem.

Your very first step? Tell the facility manager straight away. Whether it’s theft, a leak, or something else, they need to know immediately. They can secure your unit, review any CCTV footage, and give you an incident report, which will be essential for your claim.

What to Do First and What You'll Need

If you’ve been the victim of a break-in, you must report it to the police. This isn't just a suggestion; your insurer will almost certainly ask for a crime reference number to proceed with any theft claim. Without that official report, proving your loss becomes incredibly difficult.

Next, get your phone out and start documenting. Take plenty of clear photos and videos of the damage—to the unit, the lock, and your items. It’s crucial to do this before you touch, move, or clean up anything. This is your evidence.

The golden rule for a smooth claims process is: document everything. The more proof you have of the incident and your ownership of the items, the stronger your claim will be. This detailed evidence trail is your best tool for securing your rightful compensation.

Building a Strong Case for Your Claim

With the immediate actions taken, it’s time to build the core of your claim. This involves creating a comprehensive list of every single item that was stolen or damaged. It might feel like a daunting task, but it’s absolutely necessary.

For each item on your list, you'll need to gather:

- A clear description (make, model, colour, etc.).

- Proof you owned it – things like receipts, credit card statements, or even original packaging and manuals can work.

- Evidence of its value, which is typically the cost to replace it with a new, equivalent item today.

This inventory is the foundation of your entire claim. While it can be tough to go through everything, especially when you're already stressed, a thorough list is your best asset. While you hope never to find anything more than what you put in, some people have discovered all sorts of interesting and unusual things found in self-storage containers, which just goes to show why keeping a good record of your own possessions is so important.

Once you have all your evidence compiled—the manager’s report, the police reference number, your photos, and that detailed inventory—you’re ready to formally contact your insurer and start the claim. A prompt, well-documented submission gives you the best possible chance of a quick and fair resolution.

Frequently Asked Questions

When you're thinking about putting your belongings into storage, it's completely normal to have a few questions about insurance. After all, you want to be certain your things are protected. Getting clear answers is the key to choosing the right cover and feeling confident from the moment you lock up your unit.

Let's walk through some of the most common questions we get from customers just like you.

Is Storage Unit Contents Insurance a Legal Requirement in the UK?

This is a great question. While there's no UK law that says you must have it, almost every reputable self-storage facility will insist on it as part of their rental agreement. Before you can even get your keys, you’ll need to show them proof that your goods are properly insured.

Think of it as a layer of protection for everyone involved – you and the facility. You can either go with the insurance policy offered by the storage company itself or arrange your own cover through a third-party specialist and just show them the policy documents.

Does My Home Contents Insurance Cover My Items in Storage?

In most cases, the answer is a straightforward no. A standard home contents policy is designed to cover things inside your home. It typically offers very limited, if any, protection for belongings kept elsewhere for an extended period.

Some policies might have a 'goods in transit' clause, but that's usually just for the short period you're physically moving house, not for long-term storage. It's always best to dig out your policy documents and check the fine print, but you should really work on the assumption that you'll need a separate, dedicated policy.

Always assume your home insurance isn't up to the job for long-term storage. A dedicated policy is designed specifically for the risks associated with a storage environment, offering far more relevant and robust protection for your valued possessions.

How Do I Prove the Value of My Items if I Need to Make a Claim?

Good record-keeping is your best friend here. If the worst happens and you need to make a claim, solid documentation makes the whole process much smoother.

The smartest thing you can do is create a detailed inventory before you move everything into the unit.

- Hang on to receipts for more expensive items.

- Take clear photos or even a quick video of your goods once they're packed in the unit.

- Keep digital copies of these records somewhere safe.

The more evidence you have to prove what you owned and what it was worth, the simpler and faster the claims process will be.

Can I Adjust My Cover if I Add or Remove Items from My Unit?

Absolutely. Most insurance providers understand that what you store can change over time. If you add more valuable items to your unit, just get in touch with your provider to increase your sum insured to match the new total value.

The same works in reverse. If you take things out for good, you can often reduce your cover and, in turn, lower your premium. The important thing is to make sure your policy always accurately reflects the true replacement value of what’s inside your unit.

At Admiral's Yard Self Storage, we aim to make protecting your belongings simple and stress-free. Our StoreProtect scheme offers peace of mind with cover built specifically for the self-storage environment. You can explore your options and get a quick quote today at https://admiralsyard.co.uk.