Think of your self-storage unit as an extension of your home—a safe place for everything from the sofa that won’t fit in the new flat to boxes of cherished family photos. But while a sturdy lock and a secure facility are great starting points, they aren't foolproof. This is where specialised contents insurance for self storage steps in, acting as the final, crucial layer of protection for your belongings.

Why Insurance for Your Self Storage Unit Is Non-Negotiable

It’s a common and costly assumption that your home insurance policy automatically covers items you’ve put into storage. In reality, most standard home policies offer very limited cover—if any at all—for possessions stored off-site. This leaves a massive gap in your protection, exposing you to significant financial risk.

Dedicated storage insurance is designed specifically to fill that gap. You can think of it like travel insurance; you buy it hoping you’ll never have to use it, but it’s absolutely essential if something goes wrong. It protects your items against real-world risks that even the best-run facilities can't always prevent.

What Are the Real Risks?

Top-notch facilities offer 24/7 CCTV, robust alarm systems, and controlled access. Even so, the unexpected can happen. A dedicated insurance plan is built to cover these specific scenarios, giving you a financial safety net.

- Theft and Vandalism: If someone breaks into your unit, your insurance helps cover the cost of what was stolen or damaged.

- Fire Damage: Fires can start for many reasons and spread quickly. This cover ensures you can replace items lost to smoke and flames.

- Water Damage: Whether from a burst pipe, a leaking roof, or localised flooding, water can ruin everything from electronics to important documents.

- Natural Disasters: Storms and other severe weather events can cause structural damage to facilities, and this cover protects the contents inside.

Storing your goods without dedicated cover is a financial gamble. The modest monthly cost of a protection plan is a drop in the ocean compared to the crushing expense of replacing everything you own after a disaster.

The UK self-storage industry is bigger than you might think, valued at over £1.2 billion and offering a colossal 64.3 million square feet of space. This boom shows just how many people and businesses rely on these facilities. With so many valuable items concentrated in one place, having the right protection isn't just a good idea—it's essential.

Why You Need Self Storage Insurance at a Glance

This table breaks down why relying on other forms of insurance isn't enough and how a dedicated policy offers the protection you actually need.

| Risk Factor | Why Standard Insurance May Fall Short | How Specialised Storage Insurance Protects You |

|---|---|---|

| Location Clause | Most home insurance policies only cover goods at your listed home address, with minimal or no cover for items stored elsewhere. | Provides specific, guaranteed cover for items located at a designated self-storage facility. |

| Specific Perils | Home policies might not cover risks unique to storage environments, like damage from a neighbouring unit's leak or pest infestation. | Policies are designed to cover perils common to storage facilities, including fire, flood, theft, and malicious damage. |

| Value Limits | The "away from home" cover on a home policy often has a very low value cap, which is easily exceeded by furniture or business stock. | Allows you to declare the full replacement value of your stored items, ensuring you're not underinsured. |

| Liability Gaps | A storage facility's liability is typically limited, covering only their own negligence, not external events like a natural disaster or theft. | Your policy covers the value of your goods, regardless of who is at fault for the loss, providing a direct route to claim. |

In short, a specialised policy closes the dangerous gaps left by other types of cover, making sure your belongings are properly protected.

Securing Your Peace of Mind

Ultimately, arranging proper insurance is about managing risk. It transforms a potential financial disaster into a manageable inconvenience, ensuring you can replace what was lost without draining your savings. It’s a fundamental part of a smart storage plan.

Of course, insurance works best when paired with good physical security. Taking the time to research and invest in choosing the best padlocks for storage units adds another strong deterrent. By combining a high-quality lock with a comprehensive insurance policy, you give your valued possessions the complete protection they deserve.

What Your Policy Actually Covers (and What It Doesn't)

When you take out contents insurance for self storage, you're buying a promise. But not all promises are created equal, and it's crucial to read the fine print before you need to make a claim. Think of your policy as a safety net; you need to know exactly what it will catch if things go wrong.

Most good policies are built on a solid foundation, protecting you against the kind of major events that could wipe out your belongings. They’re there for the big stuff, the unpredictable disasters.

What’s Generally Included?

At its heart, self storage insurance is there to shield you from catastrophic loss. While the exact wording might differ between providers, any worthwhile policy will almost certainly cover you for:

- Fire: This isn't just about flames. It also covers the devastating damage caused by smoke and soot, which can easily ruin furniture, clothes, and electronics.

- Theft: Protection against break-ins is a must. This cover usually depends on there being clear evidence of forced entry, which is why a high-quality padlock is so important.

- Water Damage: Whether it’s from a burst pipe, a leaking roof, or even localised flooding, this protects your items from being ruined by water.

- Storms and Natural Disasters: If a serious weather event damages the facility and your unit, your policy should step in to cover the value of your damaged goods.

Let's say you're storing the entire contents of your two-bedroom flat while renovating. A freak storm damages the storage centre's roof, and rainwater floods your unit, destroying your sofas and beds. This is exactly what your insurance is for—it would cover the cost of replacing them.

Common Exclusions: What You Can’t Store

Knowing what isn't covered is just as important as knowing what is. Both storage facilities and insurers are very clear about prohibited items. Storing them won't just mean those specific things aren't covered; it could invalidate your entire policy.

A self storage policy is built to protect everyday household and business items. It simply isn't designed for high-risk, perishable, or irreplaceable goods.

You’ll find these categories are pretty much always on the "no-go" list:

- Financial Items: Cash, credit cards, securities, and precious metals like bullion are never covered.

- High-Value Jewellery: While some policies might cover very low-value pieces, expensive watches, jewellery, and precious stones are almost always excluded or have tiny limits.

- Flammable and Hazardous Materials: This is a big one. Think petrol, paint, gas canisters, fireworks, or anything toxic, explosive, or corrosive.

- Living Things: It might seem obvious, but you can't store plants, animals, or perishable food that could attract pests and rot.

- Illegal Items: Storing firearms, explosives, or any illegal substances is strictly forbidden and will terminate your agreement instantly.

A box of old family photos is usually fine, but you shouldn't store irreplaceable heirlooms or the original deeds to your house. Insurance can't replace sentimental value, so it's always wisest to keep those items with you.

Understanding Policy Limits: The Devil is in the Detail

Beyond the list of what you can and can't store, you have to get to grips with the financial limits of your policy. This is where many people get caught out. There are two key numbers you absolutely must check.

| Policy Limit Type | What It Means | A Real-World Example |

|---|---|---|

| Total Value Limit | The absolute maximum an insurer will pay for a single claim, no matter how much your things were actually worth. | You insure your goods for £10,000, but their true replacement value is £15,000. If a fire destroys everything, the most you can claim is £10,000. |

| Single Item Limit | The maximum amount you can claim for any one item, or a pair or set of items. This limit is often around £500 to £2,000. | You store an antique clock worth £3,000, but your policy's single item limit is £1,500. If it's stolen, you will only get back £1,500. |

Taking a few minutes to really understand your policy means you can pack your unit with confidence, knowing exactly what's protected. That little bit of diligence now ensures your insurance actually does its job when you need it most.

Comparing Your Options: Store-Provided vs. Third-Party Insurance

When it comes to insuring the contents of your self-storage unit, you’ve essentially got two main routes to take. You can go with the protection plan offered directly by the storage facility, or you can find your own policy from an independent, third-party insurer.

Neither path is necessarily better than the other. The right choice for you will come down to what you’re storing, your budget, and what you value most – be it convenience or customisation. Let's break down what each option really means for you.

The Case for Store-Provided Cover

For many, the sheer simplicity of using the facility's own protection plan is a huge draw. It means you can sort out your cover at the same time you're signing the rental agreement, ticking two big jobs off the list in one go. It’s a clean, efficient process.

This approach comes with some clear advantages:

- Unbeatable Convenience: Everything is sorted under one roof. Your protection fee is usually tacked onto your monthly storage bill, so you have just one simple payment and no extra admin to worry about.

- Seamless Integration: The cover is built specifically for that facility. You won’t have to second-guess whether your policy meets the storage provider’s minimum security standards – it’s guaranteed to be compliant.

- Simplified Claims: If the worst happens and you need to make a claim, the facility staff are right there on-site and know the procedure inside-out. Dealing with familiar faces can make a stressful situation feel far more manageable.

Think of it like buying a new car and getting the manufacturer’s warranty included. It's a direct, fuss-free solution designed to work perfectly with the service you're already paying for.

The Argument for Third-Party Insurance

The alternative is to shop around for a policy from an independent insurance company. This route demands a bit more legwork and research, but it can pay off, especially if you have specific needs or you're keen to find the best possible deal.

Here’s why you might lean towards a third-party policy:

- Potential Cost Savings: By comparing quotes from various insurers, you might just find a more competitive price for the same level of cover. A little time spent researching could save you money in the long run.

- Greater Flexibility: You may find policies with higher single-item limits, which is crucial if you're storing valuable antiques, art, or equipment. They might also offer cover for specialist goods that a standard facility plan excludes.

- Existing Relationships: It's sometimes possible to add storage cover to your existing home contents policy. Just be sure to read the small print very carefully to confirm it provides adequate protection for items stored away from home.

This approach is more like using a price comparison website to find a better deal on your energy bills. It takes a little more effort, but the potential to find a cheaper or more suitable plan can make it worthwhile. If you're storing particularly valuable or specialised items, it's always worth exploring every option. For a deeper look at how to protect high-value goods, you can learn more about our secure storage solutions for items like biometric gun safes.

The most important factor isn't who provides the cover, but whether the cover is right for you. Always compare the total value limits, single-item limits, and the list of exclusions before making your final choice.

To help you see the differences more clearly, we’ve put together a head-to-head comparison.

Store-Provided vs. Third-Party Insurance: A Head-to-Head Comparison

This table breaks down the key features of each option, helping you weigh the convenience of a facility-provided plan against the potential flexibility of an independent policy.

| Feature | Store-Provided Cover (e.g., StoreProtect) | Third-Party Insurance Policy |

|---|---|---|

| Convenience | Excellent. Set up in minutes when you rent your unit. One monthly payment often covers both storage and protection. | Fair. Requires you to research, compare quotes, and manage a separate policy and payment. |

| Cost | Fixed and transparent, but may not be the cheapest option available. | Potentially lower. Shopping around can uncover more competitive premiums for similar levels of cover. |

| Coverage | Standardised cover designed to meet the needs of most customers. May have lower single-item limits. | Can be more customisable. You may find policies with higher limits or add-ons for specialist items. |

| Claims Process | Often simpler. You liaise directly with the on-site facility team who guide you through the process. | Can be more complex. You will need to deal with an external claims department and provide all necessary documentation. |

| Suitability | Ideal for those who value simplicity and want a quick, integrated solution. | Best for those willing to do some research to find potential savings or who have specialised insurance needs. |

Ultimately, choosing between store-provided and third-party cover is a personal decision. Take a moment to weigh the convenience against the potential for savings and customisation to find the protection that gives you the most peace of mind.

How to Accurately Value Everything in Your Storage Unit

One of the easiest traps to fall into when arranging contents insurance for self storage is simply guessing the value of your belongings. It’s tempting to pull a number out of thin air, but that quick guess can leave you seriously underinsured. If the worst happens, you could find yourself massively out of pocket.

Taking the time to do a proper valuation isn't just paperwork—it's the single most important step in getting the right protection.

Before you can even think about a final figure, you need to know exactly what you’re storing. This is where a solid master inventory strategy comes in. It’s all about creating a detailed list, which forms the foundation of an accurate valuation and ensures nothing gets overlooked. Go through your things methodically, box by box, and write it all down.

For big-ticket items like your sofa or TV, jot down the make, model, and its general condition. But don't stop there. All those smaller things—the books, the kitchen gadgets, the winter clothes—they add up surprisingly fast.

Replacement Value vs Actual Cash Value

Here’s a crucial point that can make a huge difference to a potential payout: understanding ‘new for old’ versus ‘actual cash value’.

- ‘New for Old’ Cover (Replacement Value): This is what you’ll find with most self storage policies. It means you’re covered for the full cost of replacing a lost or damaged item with a brand-new one. No deductions are made for age or wear and tear.

- Actual Cash Value (ACV): This is different. It only pays out what the item was worth at the moment it was lost, factoring in depreciation. A five-year-old laptop, for example, would be valued at a fraction of its original price.

Most reputable storage protection plans are based on the ‘new for old’ replacement value. This is the figure you should be working with. It reflects the real-world cost of getting your life back on track after a disaster.

To get a grip on your valuation, use the tools you have. Your phone is your best friend here. Photograph or video everything as you pack, paying special attention to your more valuable possessions. If you have digital receipts for things like electronics or furniture, even better. Keep them safe, as they're concrete proof of value.

A Practical Checklist for Your Valuation

A systematic approach takes the guesswork out of the equation. Follow these simple steps to build a reliable inventory and calculate an accurate total value for your insurance cover.

- Start Your Inventory List: Fire up a simple spreadsheet or use an inventory app. List every item, a brief description, and its estimated replacement cost.

- Research Replacement Costs: Don't guess. Hop online and search for the current price of a new, similar model for your electronics, furniture, and appliances.

- Photograph Everything: A visual record is gold. Take clear pictures of your items before they go into storage, especially anything of high value.

- Group Smaller Items: For things like kitchen utensils or clothes, you don't need to list every single fork. You can estimate their value by the box. For example, "Box of kitchenware – approx. £300."

- Don’t Forget Sentimental Value: While you can't insure the sentimental attachment, you can insure the physical item. Consider the cost to professionally restore a damaged photo album or replace a unique picture frame.

- Add It All Up: Once your list is complete, just total the replacement costs to get your final valuation. This is the number you need to give your provider.

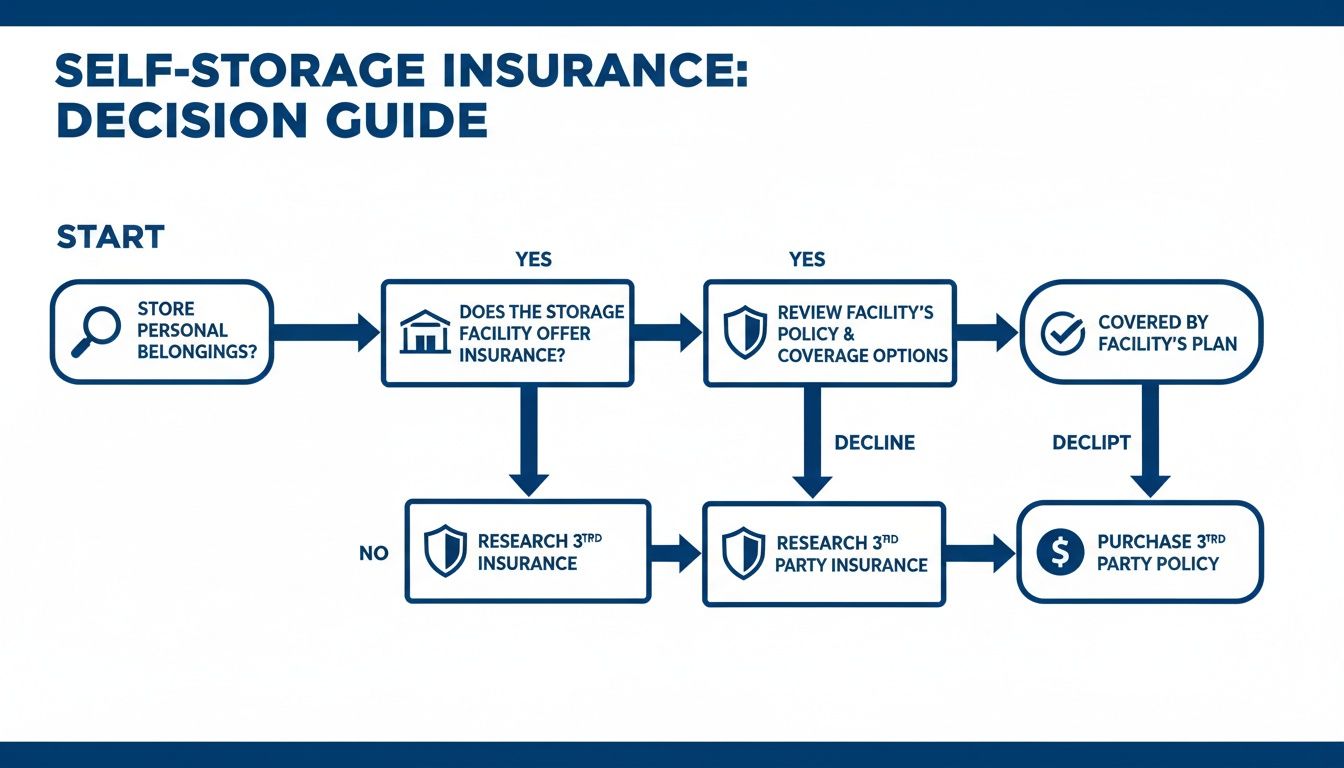

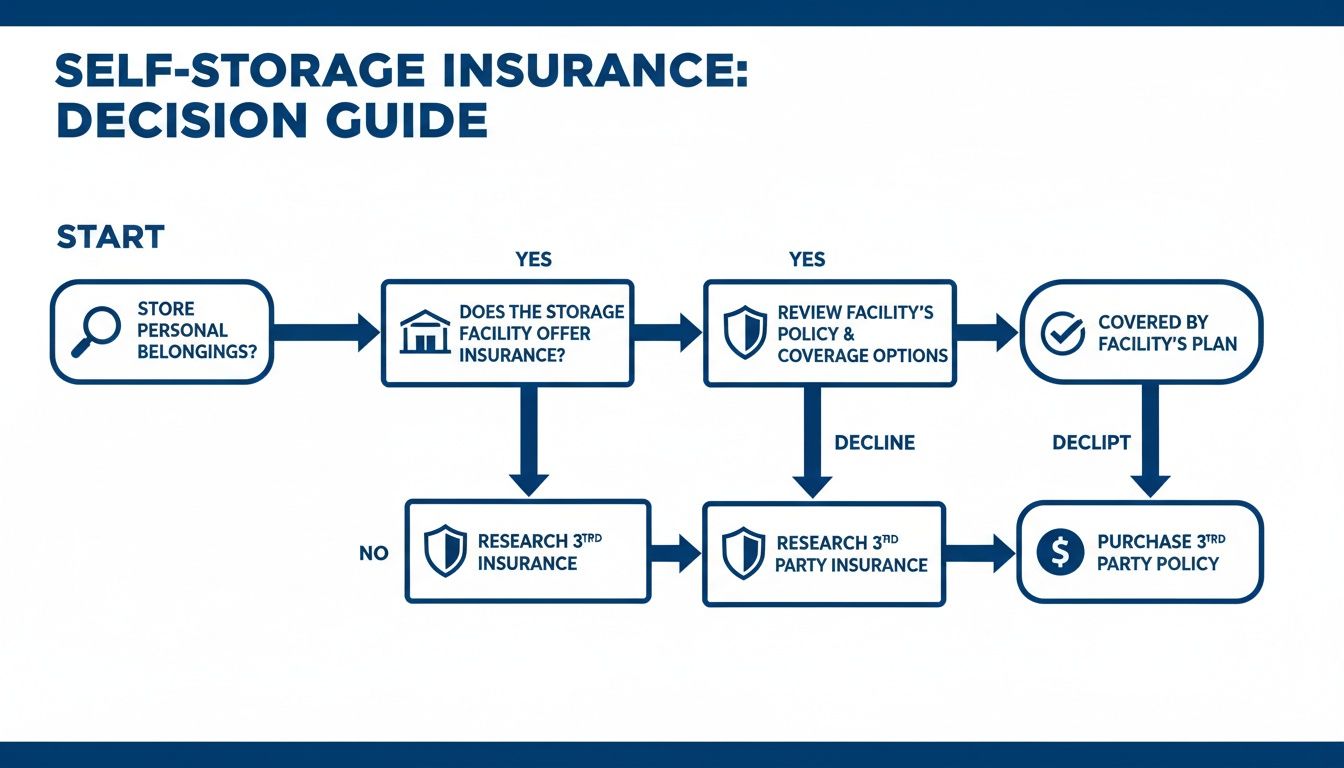

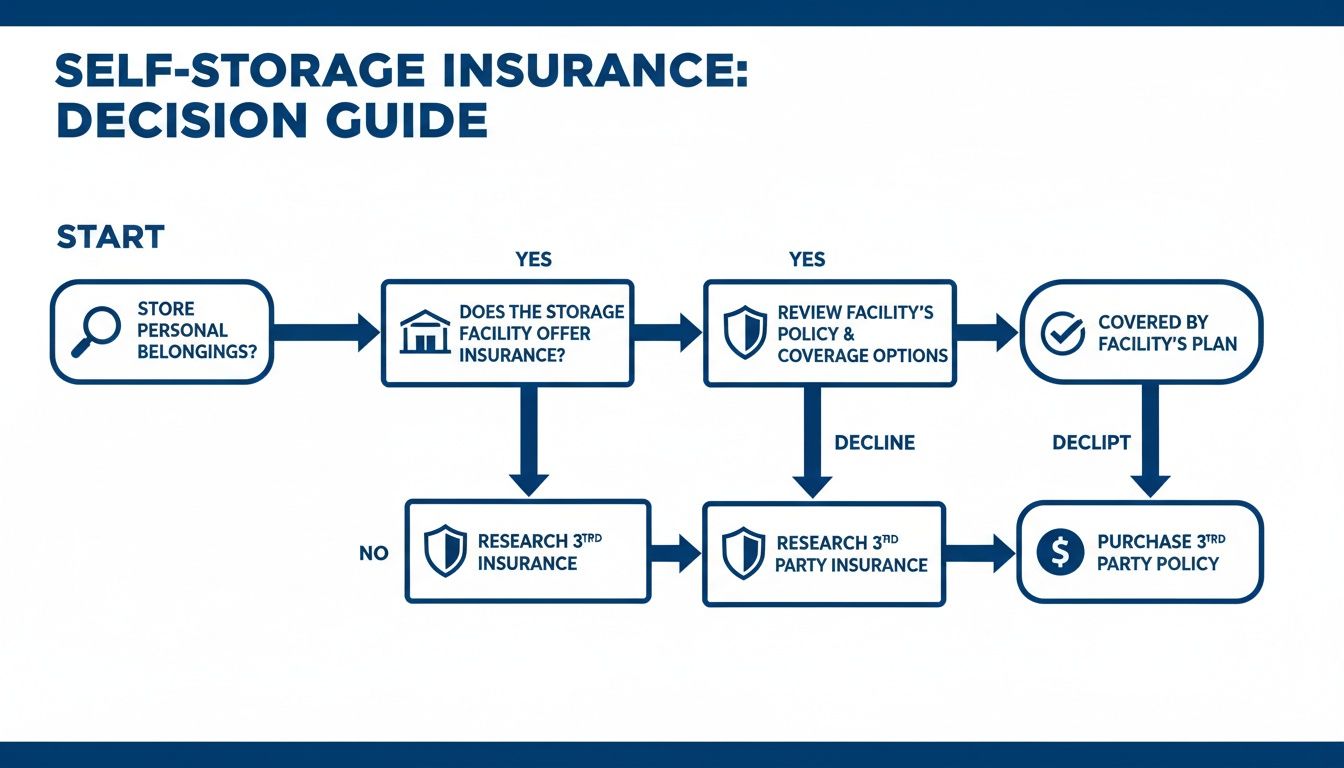

This flowchart gives you a simple visual guide to figuring out the best insurance route for you.

As the chart shows, the first step is always to assess your needs—and that starts with getting the value right. From there, you can decide whether the convenience of a facility-provided plan or the flexibility of a third-party policy is the best fit. Remember, a bit of organisation goes a long way. Using good quality, easy-to-label containers like these Akro-Mils organisational boxes can make the whole inventory process much less of a headache.

A Practical Checklist for Getting Your Storage Insurance Sorted

Figuring out insurance for your self-storage unit can feel like another chore on an already long list, but it's one you can't afford to skip. Getting it right is actually pretty straightforward if you tackle it one step at a time. This simple checklist will walk you through the process, cutting out the jargon and making sure you end up with the right protection.

Follow these seven steps, and you’ll know exactly what you’re covered for, what you’re paying, and can walk away with complete peace of mind.

Step 1: Get a Handle on What You’re Storing

First things first: you need a clear picture of everything you plan to put in your unit. Take the time to create a detailed inventory list. It might seem tedious, but this list is the backbone of your insurance cover and will be a lifesaver if you ever need to make a claim.

Don’t just write down vague terms like "boxes of kitchen stuff." Be specific. "Set of 6 Denby dinner plates," "Le Creuset cast iron casserole dish," and "Nespresso coffee machine." The more detail, the smoother any future claim will be.

Step 2: Figure Out the Replacement Value

With your inventory in hand, it's time to work out how much it would cost to buy every single item again, brand new, at today's prices. This is what insurers call the 'new for old' value. A quick search on retail websites for similar furniture, electronics, and other big-ticket items will give you an accurate total.

It can be tempting to underestimate the value to get a cheaper premium, but this is a false economy. If you’re underinsured, you'll only get a fraction of what you need to replace your belongings, leaving you seriously out of pocket.

Step 3: Check Your Home Insurance Policy (Just in Case)

It’s a long shot, but it’s worth a quick check. Dig out your home contents insurance documents and look for a clause covering "goods temporarily removed from the home."

Frankly, this is rarely a viable solution. Most home policies either don't cover items in a commercial storage facility at all, or they place very tight restrictions on it, like a low value limit (e.g., £1,000) or a short time frame (e.g., 30 days). For anything other than a very short-term stay, you’ll almost certainly need a specialist policy.

A word of warning: Never just assume your home insurance has you covered. Unless you've read the small print and can point to the exact clause that provides adequate, long-term cover for a self-storage unit, it's safest to work on the basis that you need a dedicated policy.

Step 4: See What the Storage Facility Offers

Ask the team at the storage facility for a quote on their own insurance or protection plan (like StoreProtect). This is often the path of least resistance, as you can sort it all out at the same time as your rental agreement. Make a note of the cost, the maximum cover amount, the excess, and what isn't covered.

Step 5: Look at Independent Insurance Providers

Next, spend a few minutes getting quotes from third-party insurers that specialise in self-storage. A quick online search will bring up several options. This is your chance to shop around and see if you can find a better deal or a policy that offers more suitable terms, particularly if you're storing items of high value.

Step 6: Actually Read the Small Print

Whether you lean towards the facility's plan or an independent one, you absolutely must read the policy wording. It’s not the most exciting read, but it’s crucial. Keep an eye out for these three things:

- Exclusions: What specific items (like jewellery or documents) or events (like mould or mildew) are not covered?

- The Excess: This is the amount you have to contribute towards a claim. How much is it?

- Single Item Limit: Is there a cap on how much they’ll pay out for any one item? This is vital if you have valuable electronics or antiques.

Step 7: Finalise the Paperwork and Match the Dates

Once you’ve made your choice, it’s time to buy the policy. The most important thing here is to make sure the insurance start date is the exact same day your storage rental begins. You don’t want any gaps in cover.

Save a digital copy of your policy documents somewhere safe and maybe even print one out. A little organisation now pays dividends later. And on that note, using proper storage solutions, such as these foldable and waterproof wheeled boxes, makes the whole inventory and valuation process a lot less painful.

Frequently Asked Questions About Self Storage Insurance

Even after doing your homework, a few questions about contents insurance for self storage can still linger. Let's tackle some of the most common ones we hear, so you can lock in your protection with total confidence.

Is Self Storage Insurance a Legal Requirement in the UK?

This is a great question, and the short answer is no—there isn't a specific law that mandates it. However, you'll find that virtually every reputable self-storage facility in the UK requires you to have cover as a condition of your rental agreement.

Think of it less as a legal hurdle and more as a crucial part of the facility’s commitment to security for everyone. It's a sensible rule that protects the entire community of storers. If a fire or flood in a neighbouring unit were to damage your belongings, this requirement ensures you aren’t left high and dry, hoping someone else is insured.

So, while it's not a law, it’s a non-negotiable industry standard. It gives the facility confidence that the goods on their premises are protected and gives you the invaluable peace of mind that a proper financial safety net provides.

Will My Home Insurance Cover My Items in Storage?

This is probably the most common (and riskiest) assumption people make. It’s easy to think your existing home contents policy will stretch to cover your stored items, but in reality, it almost certainly won't provide the level of protection you need.

Most home insurance policies include a small clause for 'goods temporarily removed from the home', but it's usually designed for very specific, short-term situations and is riddled with limitations.

- Low Payout Limits: The cover is often capped at a low figure, maybe £1,000, which is rarely enough to cover the full value of a storage unit's contents.

- Strict Time Frames: This cover is usually only valid for a short window, like 30 or 60 days during a house move. Once that period expires, your items are left uninsured.

- Storage Exclusions: Many home policies explicitly state that they will not cover items kept in a commercial self-storage facility.

The golden rule is this: assume your home insurance does not cover you unless you've scoured the small print and have it in writing from your insurer. A dedicated self-storage policy is always the safer, smarter choice.

What Is the Process for Making a Claim?

Hopefully, you'll never have to make a claim, but knowing the steps beforehand can make a stressful situation feel much more manageable. The process is generally quite logical.

The first couple of steps are critical. If you discover a problem like theft or damage, your first port of call is the storage facility manager. Let them know immediately. If a crime has occurred, you also need to contact the police to report it and get a crime reference number—this is absolutely essential for your insurance claim.

With that done, get in touch with your insurance provider as soon as you can. They’ll start the claims process and guide you on what to do next. This is where all your earlier prep work really pays off. You'll need to supply them with:

- Your detailed inventory list.

- Any photos or videos of your items.

- Receipts or proof of ownership, especially for more valuable goods.

- The crime reference number from the police (if it was a crime-related incident).

The insurer might send out an assessor to look at the damage. The key takeaway? Being organised with your paperwork is the single best thing you can do to ensure the whole process is as smooth, fast, and successful as possible.

How Do I Insure High-Value Items Like Antiques?

This is a vital question if you're storing anything beyond typical household goods. Standard insurance policies are brilliant for furniture, clothes, and boxes of books, but they have built-in limits that can easily catch you out with more valuable pieces.

The crucial term to understand is the single-item limit. A typical policy might cap the payout for any one item at, say, £1,500. If your antique grandfather clock is worth £4,000, you’d be left with a major shortfall if the worst happened.

To protect high-value items correctly, you have to be completely upfront with your insurer from day one. You must declare each specific item before you take out the policy. They will almost certainly ask for extra details, such as:

- A recent professional valuation.

- Clear, detailed photographs.

- Any information you have on its history or provenance.

You’ll likely need a specialist policy or a bespoke add-on to your standard cover, which will adjust your premium accordingly. Don't be tempted to keep quiet about a valuable item to save a few pounds—it could invalidate your entire claim. Being transparent ensures your most treasured possessions get the robust protection they deserve.

At Admiral's Yard Self Storage, we believe in making protection simple and clear. Our friendly teams on-site can talk you through all your options, including our StoreProtect plan, to make sure you find the right level of cover for your peace of mind. To find the perfect storage solution for your needs, visit us at https://admiralsyard.co.uk.